Green into the future

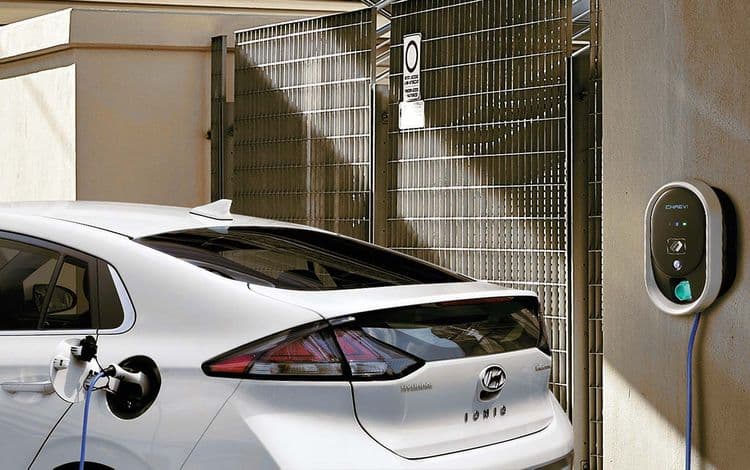

Power consumption for the Hyundai IONIQ Electric 100 kW (136 PS): front-wheel drive combined: 13.8 kWh/100 km. CO2 emissions combined: 0 g/km (combined). CO2 efficiency class: A+; vehicle illustration may differ and may contain optional extras that are subject to a surcharge*. I.

Power consumption for the Hyundai IONIQ Electric 100 kW (136 PS): front-wheel drive combined: 13.8 kWh/100 km. CO2 emissions combined: 0 g/km (combined). CO2 efficiency class: A+; vehicle illustration may differ and may contain optional extras that are subject to a surcharge*. I.

Our offers

No vehicles found.

State funding

The Federal Government is promoting the spread of alternative drive systems in various ways.1

To achieve the climate targets, the Federal Government supports the purchase of vehicles with alternative drive systems with premiums, tax breaks and grants to improve the charging infrastructure. Apply for your environmental bonus from BAFA when purchasing an alternative drive system.

Tax incentives

The state also grants tax relief on the purchase of a vehicle with an alternative drive system. If the vehicle is first registered on or after 1 January 2016, it is exempt from vehicle tax for 5 years.

Charging infrastructure

The benefit of providing charging stations at the workplace has been exempt from income tax for employees since the beginning of 2017. For more information, visit the BMU website.

Company car taxation

Private journeys with company electric cars with a gross list price of less than €60,000 only have to be taxed at a flat rate of a quarter of the assessment basis. If the price is over €60,000, only half the gross list price is used for taxation.

Sie haben Fragen - wir haben Antworten

Electric cars are intuitively associated with the topic of e-mobility. The electricity required for this comes directly from the socket at home. The energy is stored in a battery using the latest and constantly evolving lithium-ion technology. When braking, the battery is automatically recharged through recuperation. The great advantage of this type of vehicle is that it is locally emission-free and does not cause any noise pollution.

- No local emissions

- Lower maintenance costs

- Virtually silent

- No nationwide charging infrastructure

- Higher acquisition costs

- Fast charging only possible up to 80%

Your electric car can be charged at any socket. For a charging speed that is up to 10 times faster, you can use a so-called wallbox. These can be purchased and installed by your electricity provider or a specialised company. The infrastructure of charging stations is constantly improving in cities and out of town. These are usually offered by large energy companies and can be used for a fee upon registration. Only electricity from renewable energy sources is made available.

Since an electric motor eliminates the usual costs for filter and oil changes, these are significantly lower than those for combustion engines. There are also no financial outlays for clutches and timing belts.

Recuperation refers to the energy recovery that can take place when braking or rolling. The kinetic energy recovered is converted into electricity and fed back into the battery.

Lithium-ion technology is becoming increasingly important in the field of e-mobility. The main component of such a battery is a base of lithium ions, which can be combined with a variety of possible metals. The reactive materials contain lithium ions in both the positive and negative electrodes. Lithium batteries are used to store energy in motor vehicles.

With the KONA models and the IONIQ series, Hyundai offers a wide range of vehicles with alternative drive systems. According to the manufacturer*,*** the IONIQ series will be expanded into its own sub-brand with many more models*** in the coming years.*** With the Outlander plug-in hybrid***, Mitsubishi is offering the world's first all-round SUV. At CSB Schimmel Automobile you will find all models of the Hyundai & Mitsubishi brands.

With the Outlander Plug-in Hybrid**, Mitsubishi offers the world's first all-round SUV. Hyundai has been impressing with the comfortable IONIQ plug-in hybrid*** since 2016. With its own IONIQ sub-brand, Hyundai will continue to deliver impressive innovations in the field of modern e-mobility in the coming years. At CSB Schimmel Automobile you will find all models of the Hyundai & Mitsubishi brands.

Half and annual cars

Everything under one roof

35 years of experience

Um diesen Inhalt anzeigen zu können, ist Ihre Zustimmung erforderlich.

* Weitere Informationen zum offiziellen Kraftstoffverbrauch und den offiziellen spezifischen CO2-Emissionen neuer Personenkraftwagen können dem 'Leitfaden über den Kraftstoffverbrauch, die CO2-Emissionen und den Stromverbrauch neuer Personenkraftwagen' entnommen werden, der an allen Verkaufsstellen, bei der Deutschen Automobil Treuhand GmbH (DAT), Hellmuth-Hirth-Str. 1, 73760 Ostfildern-Scharnhausen, und unter https://www.dat.de/co2/ unentgeltlich erhältlich ist. Die angegebenen Verbrauchs- und CO2-Emissionswerte wurden nach dem vorgeschriebenen WLTP-Messverfahren ermittelt.

** Stromverbrauch in kWh/100 km kombiniert für den Hyundai Ioniq Elektro: 13,8; CO2-Emissionen in g/km kombiniert: 0; CO2-Effizienzklasse: A+.

*** Mitsubishi Outlander Plug-in Hybrid Gesamtverbrauch: Stromverbrauch (kWh/100 km) kombiniert 14,8. Kraftstoffverbrauch (l/100 km) kombiniert 1,8. CO2-Emission (g/km) kombiniert 40. Effizienzklasse A+.

**** hyundai.news/de/modell-news/hyundai-motor-company-gibt-neue-submarke-ioniq-bekannt/ (zuletzt besucht: 23.10.2020)

© 2026 CSB Schimmel Automobile GmbH. All rights reserved.

Die Setzung einiger Cookies ist zwingend erforderlich. Für bestimmte Dienste benötigen wir Ihre Einwilligung.

Durch den Klick auf „Alle Cookies akzeptieren“, willigen Sie (jederzeit für die Zukunft widerruflich) in alle Datenverarbeitungen (Setzung von Cookies und Übermittlung der IP-Adresse an Partner) ein.

Durch den Klick „ Alle optionalen Cookies ablehnen“ werden alle nicht zwingend notwendigen Cookies nicht gesetzt und Verbindungen unterbunden. Die Nutzung unserer Webseite ist dann stark eingeschränkt.

Durch den Klick auf „ Lassen Sie mich wählen“ können Einstellungen geändert und der Datenverarbeitung eingewilligt werden. Ihre Auswahl kann jederzeit angepasst werden.

Hinweis auf Verarbeitung der Daten in den USA (z.B. durch Google, Facebook, Youtube): Durch den Klick auf „Alle Cookies akzeptieren" oder bei der entsprechenden Auswahl eines Anbieters, willigen Sie zugleich darin ein, dass Ihre Daten in den USA verarbeitet werden. Die USA wird als ein Land mit einem nicht ausreichenden Datenschutzniveau angesehen. Es besteht u.a. das Risiko, dass Ihre Daten durch US-Behörden, zu Kontroll- und zu Überwachungszwecken, möglicherweise auch ohne Rechtsbehelfsmöglichkeiten, verarbeitet werden können. Bei dem Klick auf „Alle optionalen Cookies ablehnen“, findet keine Datenübermittlung statt.

Weitere Informationen finden Sie unter Datenschutz. Zum Impressum.